The Arc Responds to House Passage of American Health Care Act: “Shows Callous and Dangerous Disregard for the Wellbeing of People With Disabilities”

Washington, DC – The Arc released the following statement following the House of Representatives passage of the American Health Care Act (AHCA), with the addition of amendments that take the bill from bad to worse for people with intellectual and developmental disabilities (IDD) and their families:

“Members of the House of Representatives who supported the American Health Care Act voted against their constituents with intellectual and developmental disabilities. We won’t soon forget those who so willingly ignored the pleas of their constituents who rely on the Affordable Care Act and Medicaid for comprehensive health care coverage and long term services and supports that enable them to live full lives in the community. We must call this what it is – an attack on the rights and lives of people with disabilities.

“The federal government will be walking away from a more than 50 year partnership with states when it comes to Medicaid. Deep cuts and radical restructuring will decimate the Medicaid program. With an over $800 billion cut to Medicaid, states will face difficult choices about what people to cut from the program or what services to roll back. Optional services like home and community based services are likely to be cut. Lives will be lost when people are unable to access the health care and community supports they need.

“The plan that passed the House today is insufficient to keep people with disabilities insured or to support anyone with complex medical needs. If signed into law as currently written, this bill will result in people with disabilities and their family members losing health coverage in the private insurance market and in Medicaid. Coverage also becomes unaffordable as people with pre-existing conditions lose protections against higher premiums. Those lucky enough to retain their coverage will find that some of the services they need – Essential Health Benefits – are no longer available. And Medicaid funded long term supports and services, which help people live independently and be included in their communities, will be even scarcer as waiting lists for services will grow all across the country. Some may end up living in nursing homes and institutions because community services are no longer available.

“The American Health Care Act shows callous and dangerous disregard for the wellbeing of people with disabilities and their families and erases decades of progress. Now we turn to the Senate, our last line of defense. We intend to work with Senators on both sides of the aisle to oppose this harmful legislation. We continue to encourage disability advocates across the country to reach out to their Senators to voice their concern about this bill,” said Peter Berns, CEO, The Arc.

This week, The Arc released another video illustrating how Congress’ proposed changes to the ACA and Medicaid would negatively impact Americans with disabilities and their families. The video features an interview with Toby, Lindsay, and Calvin from Fairfax, VA. Calvin has Bilateral Fronto-Parietal Polymicrogyria and Cerebral Palsy and relies on multiple insurance plans to cover his medical and therapeutic treatments.

This video is the second in a series of videos The Arc will be releasing in the coming weeks, sharing the personal stories of people with disabilities and their families, and the impact of the ACA and Medicaid on their lives. The first video featured nine people who rely on the ACA and/or Medicaid, and each one has a personal message for Members of Congress and the Trump Administration.

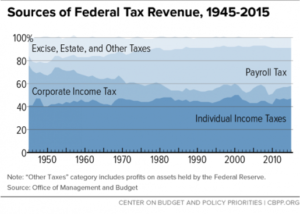

One of the reasons for this drop is changes in how corporations are operating and being taxed. An increasing number of corporations’ profits are subject to no taxation (foreign profits that stay abroad) or different taxes (income tax in the case of

One of the reasons for this drop is changes in how corporations are operating and being taxed. An increasing number of corporations’ profits are subject to no taxation (foreign profits that stay abroad) or different taxes (income tax in the case of